- HOW TO RECORD EXPENSES IN QUICKBOOKS PRO 2016 FULL

- HOW TO RECORD EXPENSES IN QUICKBOOKS PRO 2016 PROFESSIONAL

The credit consists of aggregate payroll expense (hourly, overtime, salary, welder pay, truck pay, meals per diem, lodging per diem, and probably a few others I can’t remember right now, along with taxes and an estimated workers comp cost), and is not assigned to a job. However, instead of creating zero-dollar checks, we record a zero-dollar GL entry each week. We record job costs in a manner that appears to be somewhat similar to what you suggest in this post, in that it relies on the zero-dollar concept. The Excel workbook is massaged a little bit each week, then uploaded to our payroll processor, which prepares the checks and provides a journal entry to record the necessary entries. I work for a construction company with about 60 employees. To see this technique in action, watch this video from the Sleeter Group. Enter a negative dollar amount to zero out cost from Items tab.They will appear on the Items tab at the bottom. Use the “Add Time/Costs” button to add time charges to the check (you may also get a popup asking if you want to add items say yes).Use Payroll Service Clearing as the Bank at the very top.The purpose is simply to move the cost from an Expense to a trackable cost. Don’t check Billable unless you’re passing on costs for the customer to pay. To track the hours, use the Timesheet for each of the new Vendors/Other Names, with each entry applied to a Customer:Job. You’ll use this new account moving into the future. If you already have them in as employees, make a new Other Name, with a slight variation (no two names can be exactly the same). Each person should be created either as a Vendor or an Other Name, instead of an Employee.

HOW TO RECORD EXPENSES IN QUICKBOOKS PRO 2016 FULL

HOW TO RECORD EXPENSES IN QUICKBOOKS PRO 2016 PROFESSIONAL

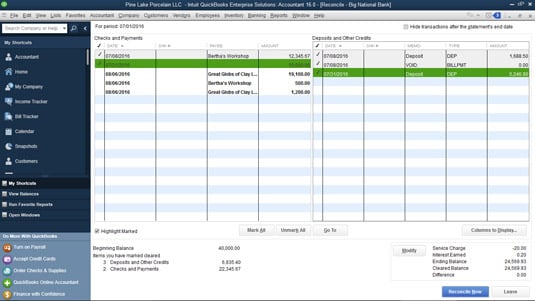

If you’re a contractor or other professional who really wants to know if you’re making any money on the jobs you do, Job Costing is essential, especially if your job expenses include payroll. It allows to you see if a project was profitable or not. QuickBooks has a powerful Job Costing feature that allows you to compare the income you made from a job to the expenses you incurred to provide the product or service.

0 kommentar(er)

0 kommentar(er)